Economic Development Opportunities

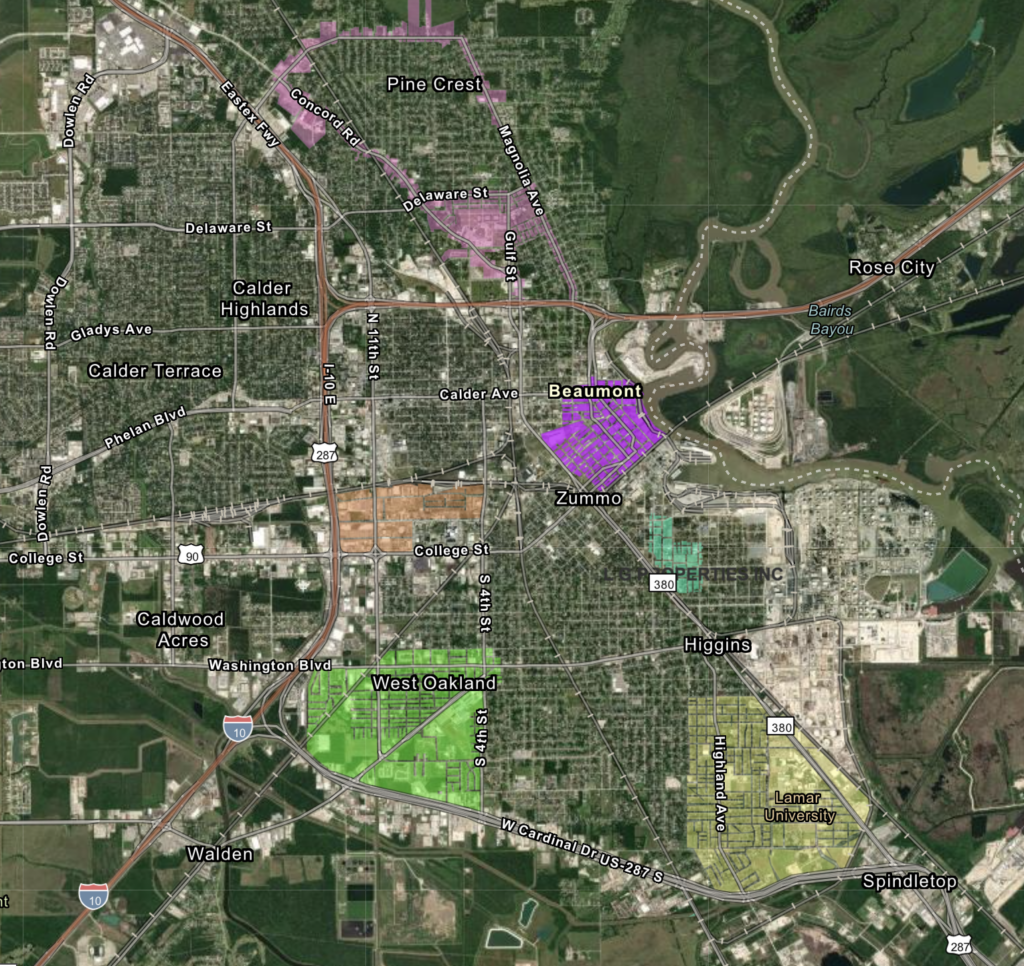

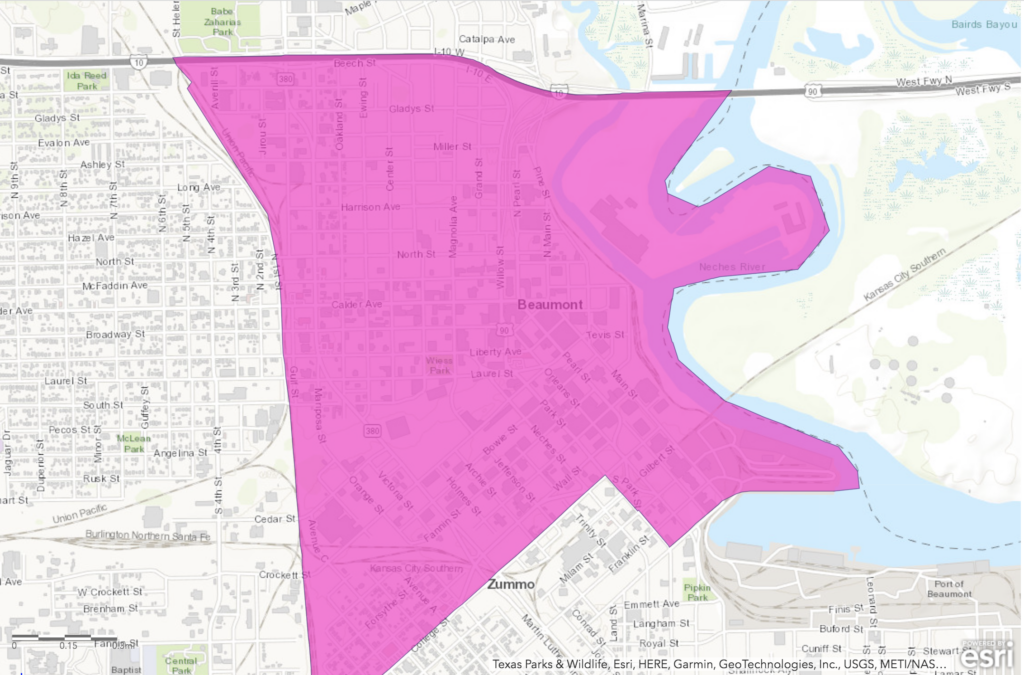

Local Neighborhood Empowerment Zones

Offers fee waivers, expedited permitting, removal of City liens and abatement of City property taxes for up to seven (7) years for eligible projects within six (6) NEZ Zones approved by City Council.

It is the City of Beaumont’s goal to promote development within its Neighborhood Empowerment Zones (NEZ Program) in an effort to improve the local economy and enhance the quality of life for its citizens. Insofar as these goals are served by enhancing the value of the local tax base and increasing economic opportunities, the City of Beaumont will give consideration to providing the following incentives for development within Neighborhood Empowerment Zones.

Neighborhood Empowerment Zone (NEZ) Incentives Available:

Building Fee Waivers

The Building Construction Fee Waiver Program affords property owners an exemption from planning and building fees associated with new construction or renovation and occupancy of eligible facilities within the target area.

Expedited Permit Reviews:

In order to facilitate redevelopment within the Neighborhood Empowerment Zones, the Community Development Department is committed to assisting applicants through the planning and permit review process as quickly as possible.

Lien Waivers

In order to render properties with Neighborhood Empowerment Zones more marketable, the Lien Waiver Program affords property owners a release of liens attached to properties as the result of demolitions or expenditures associated with cutting high grass. Release of such liens would only be allowed in conjunction with new construction or renovation of eligible facilities within the target area.

Construction Tax Abatement

The Construction Tax Abatement Program is an economic development tool designed to provide incentives for the new construction or renovation of single-family homes, office, retail, restaurant and multi-family residential facilities within a Neighborhood Empowerment Zone. The Construction Tax Abatement Program is intended to contribute to area development by attracting additional capital and human investment to the area as well as additional residents to support economic development activities within the area.

Value of Abatements: authorized facilities may be granted a municipal tax abatement on all or a portion of the increased taxable value of eligible property over the base year value for a period not to exceed three (3) years, except as outlined below.

Chapter 380 Abatements

State-authorized program to offer tax abatements as well as tax rebates to finance infrastructure necessary for an eligible project. Also able to offer Hotel Occupancy Tax rebates for eligible projects. Qualifying areas: Projects that qualify may be granted a reinvestment zone by a City Council approved ordinance.

Chapter 312 Abatements (Reinvestment Zone): Typically for Industrial

State-authorized program of property tax abatements of up to ten (10) years for eligible projects in areas identified by the State. Qualifying areas: Projects that qualify may be granted a reinvestment zone by a City Council approved ordinance.

Federal Opportunity Zones

State Enterprise Zones

Administered by the Governor’s office, the Texas Enterprise Zone Program (EZP) is a state sales and use tax refund program designed to encourage private investment and job creation in economically distressed areas of the state. The Texas Enterprise Fund awards “deal-closing” cash grants to companies considering a new project for which one Texas site is competing with other out-of-state sites. The fund serves as a performance-based financial incentive for those companies whose project would contribute significant capital investment and new employment opportunity to the state’s economy. Award amounts vary depending on average wage of new employees, number of jobs, etc.

State of Texas Historic Tax Credit

The new state Historic Tax Credit is worth 25 percent of eligible rehabilitation costs and is available for buildings listed in the National Register of Historic Places, as well as Recorded Texas Historic Landmarks and Texas State Antiquities Landmarks. The program is administered by the Texas Historical Commission (THC).